Azerbaijan's Inclusion in the Abraham Accords will Transform the Commercial Architecture of Eurasia's Southern Rim

By Michael Tanchum

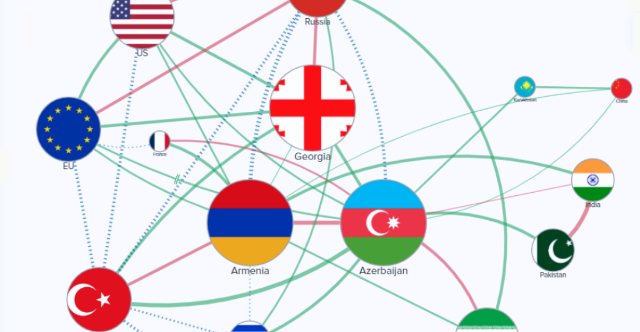

The Eastern Mediterranean and the Black Sea are one natural waterway forming the core of a multi-modal connectivity arc that can serve as the transportation backbone of a commercial corridor spanning the Middle East and Central Asia. Azerbaijan’s inclusion in a wider Abraham Accords framework could radically reconfigure trade patterns and manufacturing value chains across the southern rim of Eurasia, to the benefit of U.S. strategic interests and those of its partners. While strengthening U.S.-Israel-Azerbaijan trilateral defense cooperation is a response to the looming prospect of a military showdown with Iran, the geo-economic significance of Azerbaijan’s inclusion in the Abraham Accords is of long-term strategic consequence. With the ports on Israel’s Eastern Mediterraneancoast and Azerbaijan’s Caspian Sea coast serving as anchor points, the India-Middle East-Europe Corridor can be linked to the Trans-Caspian International Transport Route, creating an crescent of commercial cooperation from India to the Central Asian Republics via the UAE, Saudi Arabia, Jordan, Israel, Georgia, and Azerbaijan, providing counterweight to the westward expansion of Chinese economic hegemony across the Central Asia-Caucasus region and the Middle East.

Photo source: Michael Tanchum

BACKGROUND: In early March 2025, the office of Israeli Prime Minister Binyamin Netanyahu made public that it favors elevating the trilateral partnership between Israel, Azerbaijan and the U.S.. Following a motion in the Israeli Knesset on "Upgrading the Strategic Alliance between Israel and Azerbaijan," a flurry of calls arose for Azerbaijan’s inclusion in the Abraham Accords. The September 15, 2020, agreement normalized relations between the United Arab Emirates (UAE) and Israel, followed by the establishment of relations between Israel and Bahrain and Sudan, respectively, and the restoration of relations with Morocco. The Abraham Accords also consists of an expanded framework of strategic and economic initiatives among the participants, developed in partnership with the U.S.

Azerbaijan and Israel have enjoyed an all-weather strategic relationship since diplomatic relations were established in the early 1990s following Azerbaijan’s independence. The two states have developed deep defense cooperation over the past 30 years, based on countering the threat Iran poses to both Israel and Azerbaijan, which shares a 428-mile (689 km) border with the Islamic Republic. Key proponents of extending the Abraham Accords to Azerbaijan have emphasized the Azerbaijani-Israeli defense relationship’s durability and Azerbaijan’s reliability as a principal oil supplier to Israel. Azerbaijan and Israel enjoy commercial cooperation in telecoms and other technology sectors. The State Oil Company of Azerbaijan (SOCAR) recently established the new subsidiary “SOCAR Tamar” following its March 17, 2025 acquisition of a 10 percent stake in Israel’s Tamar offshore natural gas field in the Eastern Mediterranean. Azerbaijan has also played an important mediating role between Baku’s close partner Turkey and Israel during times of tension.

Netanyahu’s public commitment to strengthen Israel’s trilateral relationship with Azerbaijan and the U.S was preceded by a collection of letters sent to U.S. President Donald Trump at the end of February by prominent rabbis advocating Azerbaijan’s inclusion in the Abraham Accords. Among them was a senior rabbi in the UAE and personal friend of Trump’s son-in-law Jared Kushner, who played a key role in the signing of the Abraham Accords. Additionally, opinion pieces from Israeli and American policy communities, including in the Wall Street Journal, added further political momentum amidst escalating tensions between Washington and Tehran over Iran’s nuclear weapons program. Two days after Iran’s Supreme Leader Ayatollah Ali Khamenei’s March 12, 2025, rejection of the U.S. proposal to hold negotiations about Tehran’s nuclear weapons program, Trump’s special envoy to the Middle East Steve Witkoff visited Baku after an overnight visit to Moscow, in what appears to be a coordinated effort to prepare for possible military action against Iran by Israel or the U.S., following the exhaustion of diplomatic efforts.

IMPLICATIONS: Beyond defense cooperation, a compelling strategic and geo-economic logic exists to include Azerbaijan in a wider Abraham Accords framework, building upon the Azerbaijan’s parallel and separate bilateral economic relations with Israel and the UAE. Extending the Abraham Accords framework outside the Arab World has precedence in the quadrilateral cooperation among India, Israel, the UAE, and the U.S. – the “I2U2” framework – emerging from India’s robust yet parallel commercial cooperation and joint venture investments with Israel and the UAE. Trilateral cooperation emerged organically from the synergies between India’s commercial ventures with Israel and the UAE, traditionally India’s third-largest trading partner and Arabian Sea neighbor.

In February 2022, the UAE signed a Comprehensive Economic Partnership Agreement (CEPA) with India followed by the May 2022 signing of a similar UAE-Israel free trade agreement. The two trade agreements paved the way for initiating three-way coordination in developing an India-Middle East Corridor. Quadrilateral cooperation involving the U.S. was then formalized with the July 2022 I2U2 summit.

The extended Abraham Accords cooperation gave rise to a vision of an India-to-Europe commercial corridor in which the UAE’s ports serve as the Indian Ocean connectivity node with Israel’s Eastern Mediterranean ports serving as the maritime outlet to Europe, connected by a UAE-to-Israel railway network transiting Saudi Arabia and Jordan. Once the transportation route is operational, Indian goods leaving Mumbai could arrive on the European mainland in as little as 10 days. An initiative to realize this corridor, now known as the India-Middle East-Europe Corridor (IMEC) was formalized with the signing of the September 9, 2023, Memorandum of Understanding at the New Delhi G20 Summit, with India, the U.S., the UAE, Saudi Arabia, France, Germany, Italy, and the EU as signatories.

Research has shown that commercial corridors only emerge where the requisite large investments in port and rail infrastructure are coupled with an industrial base anchored in manufacturing value chains. The IMEC is highly conducive for value chain integration because of the existing synergies between India’s commercial ventures with its Arab Gulf partners and its commercial ventures with Israel, as exemplified by the manufacturing value chain in food production that is one of the leading drivers of the IMEC’s development. India’s “Food Corridor to the Middle East” is driven by India’s investment partnerships with the UAE and Saudi Arabia that rely on the transformation of India’s agriculture and water management sectors being implemented through India’s partnership with Israel. Similar synergies exist in other sectors, with the most promising in green energy and innovative technology, which has already lead to joint venture production facilities in green manufacturing.

The inclusion of Azerbaijan, along with Georgia, in the wider Abraham Accords framework holds a similar potential to create a new trans-regional commercial architecture. The UAE is Azerbaijan’s top Arab trading partner, accounting for 40 percent of Azerbaijan’s trade with the Arab World. The UAE is also the largest Arab investor in Azerbaijan and one of the top 10 global investors in Azerbaijan, accounting for 7 percent of Azerbaijan’s FDI inflow. In 2023, the UAE’s Abu Dhabi National Oil Company acquired a 30 percent stake in Azerbaijan’s Absheron natural gas field in the Caspian Sea. Similarly, the UAE is Georgia’s largest trading partner in the Arab world, accounting for 63 percent of Georgia’s trade with the region. Trade is likely to increase further with the UAE-Georgia CEPA, which came into effect in June 2024. The UAE is also invested in solar power plant development in both Azerbaijan and Georgia. Most significantly, in March 2024, the UAE’s AD Ports group, acquired a 60 percent ownership share in the Tbilisi Dry Port, a new custom-bonded and rail-connected intermodal logistics hub in Georgia. At the heart of the Trans-Caspian Route, the port is a key logistics facility for the rail connection linking Georgia’s Black Sea coast and Azerbaijan’s Caspian coast.

Azerbaijan’s Baku port is the connectivity node from where the Wider Black Sea region connects to Central Asia across the Caspian Sea. The Trans-Caspian International Transport Route (TITR) connecting the Caspian and Black Seas via Azerbaijan and Georgia, commonly referred to as the Middle Corridor, was developed as an alternative to the Russia-based Northern Corridor for China-to-Europe trade. The TITR consists of multi-modal transportation links for container transshipment via Kazakhstan’s Caspian port Aktau to the specially constructed port of Baku at Alat from where goods can be shipped by railway connection from Azerbaijan to Georgia’s Black Sea ports and in turn to Israel’s Eastern Mediterranean ports. By linking IMEC and the TITR, India will possess its own multi-modal corridor to access Central Asia, enabling India to effectively compete with China in Eurasia without being reliant on Russia or Iran. IMEC provides India with a streamlined alternative to its 25-year effort to establish the troubled International North-South Transit Corridor (INSTC) to access Central Asia through Iran’s Chabahar port, serving as the Indian Ocean connectivity node with overland transportation links running northward via Iran and Afghanistan.

The multi-modal corridor connecting India to Central Asia would also open the opportunity for Turkey to participate in IMEC. The UAE’s ports and logistics giant DP World operates Turkey’s Yarımca port, reputed to be the most technologically advanced in Turkey. Yarımca’s Marmara coast location is highly suited for intermodal transportation in which cargo can be transshipped to the Black Sea or Georgia and Azerbaijan by rail from Kars via the Baku-Tbilisi-Kars railway.

CONCLUSION: The September 2023 signing of the IMEC declaration was preceded by the July 2022 I2U2 summit, the first convening of the heads of government of India, Israel, the UAE, and the U.S. As a step toward linking IMEC with the Trans-Caspian Corridor, a CC-I2U2 summit should be convened with the heads of Azerbaijan and Georgia participating. The format can be extended to include Central Asian Republics as well as Saudi Arabia and Jordan in anticipation of the extended arc of joint venture manufacturing investments and commercial cooperation.

By including Azerbaijan in a wider Abraham Accords framework, the U.S. can upend the geopolitics of connectivity in Central Asia, halting the westward expansion of Chinese commercial hegemony across the Eurasian landmass. Linking the IMEC corridor to the Caspian shores of Kazakhstan via a multi-modal sea route with trans-shipment across Georgia and Azerbaijan will effectively end India’s isolation from Central Asia – a strategic objective long sought by New Delhi. Consolidating the triangle of bilateral economic relationships among Azerbaijan, Israel, and the UAE into a multilateral framework through U.S. facilitation under the Abraham Accords is a necessary first step and a boon to the U.S. strategic position across Eurasia’s southern rim.

AUTHOR BIO: Prof. Michaël Tanchum teaches international relations of the Middle East and North Africa at the University of Navarra, Spain and an associate fellow in the Economics and Energy at the Middle East Institute in Washington, D.C. He is also a Senior Associate Fellow at the Austrian Institute for European and Security Studies (AIES) and an affiliated scholar of the Centre for Strategic Policy Implementation at Başkent University in Ankara, Turkey (Başkent-SAM) and the NTU-SBF Centre for African Studies in Singapore. @michaeltanchum

With a Potential Deal in Ukraine, Russia Could Also Secure the South Caucasus

By Emil Avdaliani

Since Donald Trump’s return to office, Washington has initiated high-level negotiations with Moscow aimed at ending the conflict in Ukraine. Although the outcome of these discussions remains uncertain, it is increasingly apparent that the U.S. and Russia are moving toward finding common ground on their most contentious disputes. However, U.S. attempts to establish a lasting rapprochement with Russia will likely produce negative implications for Ukraine, undermining its sovereignty, and potentially impacting other borderland areas, notably the South Caucasus, where Russia challenges Western influence.

Photo source: NASA.

BACKGROUND: Each of the three South Caucasus countries—Armenia, Azerbaijan, and Georgia—has articulated distinct expectations regarding Trump's presidency. The Biden administration lacked a clear strategic vision for the South Caucasus, with Washington frequently oscillating between emphasizing human rights and democracy promotion (as exemplified by Georgia), and pursuing strategic calculations, such as swiftly signing a strategic partnership with Armenia to deepen the divide between Yerevan and Moscow. Washington's approach towards Azerbaijan similarly blended democratizing objectives with strategic considerations.

Under Biden’s administration, Georgia’s and Azerbaijan’s relations with the U.S. deteriorated, whereas Armenia, aiming to reduce its excessive reliance on Russia, benefited from Washington's policies between 2021 and 2024, culminating in the signing of a strategic partnership agreement in January. Consequently, all three states anticipate enhanced engagement from the Trump administration, with Azerbaijan and Georgia particularly expecting a significant shift toward greater transactionalism and realism in bilateral foreign relations.

Both Tbilisi and Baku have anticipated that under Trump their relations with the U.S. would improve. For example, Tbilisi supported the U.S.-backed UN resolution on Ukraine that diluted Russia’s responsibility for initiating the conflict. Similarly, Azerbaijani President Ilham Aliyev indicated in a statement that “…when President Trump led the U.S., our relationship developed very successfully—unlike the past four years, during which it significantly deteriorated owing to the Biden administration’s unfair and unjust stance toward Azerbaijan.”

IMPLICATIONS: A potential major agreement between the U.S. and Russia regarding Ukraine would likely affect the South Caucasus countries differently; however, the overall outcome may well be characterized by an expansion of Russian influence across the region.

Throughout Russia’s war in Ukraine, Moscow has faced significant challenges in maintaining its influence over the South Caucasus. Other powers, including China, Iran, Turkey, the Arab Gulf states, and even India, have expanded their presence in the region through substantial investments, trade agreements, and enhanced cooperation in security and energy sectors. This development has resulted in a period of regional multipolarity, where no single actor has been able to establish exclusive dominance. Consequently, Armenia, Azerbaijan, and Georgia have increasingly diversified their foreign policies, embracing a multi-vector approach beyond traditional partnerships.

Tbilisi and Yerevan have been notably successful in pursuing this strategy. For example, the Georgian government, while publicly maintaining its aspiration to join the EU, has concurrently signed a strategic partnership with China, enhanced cooperation with the Gulf Cooperation Council, and developed stable relations with Russia, despite the latter’s ongoing occupation of two Georgian regions. Armenia, aiming to reduce its reliance on Moscow, has sought increased military cooperation with India, explored the possible normalization of relations with Turkey, and, most significantly, announced its intention to seek EU membership.

Nevertheless, with a potential agreement on Ukraine, Russia would once again have the capacity to redirect resources into the South Caucasus to restore its weakened position. The Trump administration is unlikely to prioritize the smaller South Caucasus states, instead viewing the region primarily as within Russia’s sphere of influence. This approach aligns with Washington’s broader foreign policy objective of shifting its strategic focus toward the Indo-Pacific. Additionally, the U.S. lacks significant investments in the South Caucasus and shows limited interest in developing the Middle Corridor connecting Azerbaijan and Georgia to Central Asia.

More significantly, the South Caucasus states themselves increasingly perceive momentum shifting in the Kremlin’s favor and appear unlikely to oppose this declining trend. A potential agreement on Ukraine, which would solidify Russian gains, is expected to accelerate this shift toward Moscow. Indeed, Georgia and Azerbaijan have already anticipated such developments; what initially emerged as a policy of appeasement following Russia's invasion of Ukraine in 2022 has since evolved into a understanding that the balance of power in the region favors Russia. This shift partially reflects necessity, as Western powers were—and remain—unlikely to provide meaningful military assistance, while Russia continues to pose a credible threat despite its engagement in Ukraine.

Moreover, Georgia's approach reflects a deliberate foreign policy strategy implemented by the ruling Georgian Dream (GD) party, in power since 2012, aimed at developing a multi-vector diplomatic stance. Integral to this approach is the recognition of Russia's regional influence and a corresponding effort to maintain stable relations with Moscow. Although Georgia and Russia lack formal diplomatic relations, their bilateral economic ties have expanded considerably. Additionally, Tbilisi has subtly indicated declining enthusiasm for NATO and EU membership, both particularly contentious issues from Moscow's perspective.

In contrast, Baku possesses a considerably broader set of tools to counterbalance Russian influence, occasionally resulting in bilateral tensions, as exemplified by the recent incident involving a downed Azerbaijani aircraft. Nevertheless, geographical proximity, significant economic linkages, and Russia's formidable military presence will ultimately compel Azerbaijan toward reconciliation with Moscow. Indeed, signs of rapprochement are already evident through subtle gestures, such as the unveiling of a statue in Moscow honoring Heydar Aliyev, the father of current Azerbaijani President Ilham Aliyev, and Baku's hosting of the 22nd session of the bilateral inter-parliamentary commission.

Even in the case of Armenia, which signed a strategic partnership agreement with the U.S. shortly before Biden left office, it remains uncertain whether Washington will seriously commit to its implementation. Previous experiences are particularly instructive: between 2008 and 2024, Georgia maintained a strategic partnership agreement with the U.S., covering issues such as preparation for a free trade agreement, visa liberalization, and enhanced military and security collaboration. However, few tangible outcomes materialized, suggesting a similar pattern could emerge for Armenia. Early indicators are indeed discouraging, as evidenced by the reported postponement of a planned U.S. delegation visit to Yerevan. Additionally, Armenia's prospects for EU membership remain remote, given Georgia's ongoing difficulties with Brussels and internal disagreements within the EU regarding enlargement. Consequently, these factors will likely prompt Armenia to moderate its stance toward Russia, returning to full-scale cooperation even while maintaining certain aspects of its multi-vector foreign policy.

CONCLUSION: In the context of a potential rapprochement between Russia and the U.S. over Ukraine, the South Caucasus emerges as particularly vulnerable. Moscow would gain an opportunity to reassert its regional influence by filling the strategic vacuum left by an increasingly disengaged Washington. Additionally, Armenia, Azerbaijan, and Georgia are likely to recalibrate their foreign policies to align more closely with Russia. Although this trend has manifested in various forms over recent years, it is expected to accelerate significantly should Moscow successfully conclude its engagement in Ukraine.

AUTHOR BIO: Emil Avdaliani is a professor of international relations at the European University in Tbilisi, Georgia, and a scholar of Silk Roads. He can be reached on Twitter/X at @emilavdaliani.

The New Russia-Iran Treaty: Implications for the South Caucasus Region

By Sergey Sukhankin

Weakened by economic sanctions and bearing significant consequences for their geopolitical endeavors, Iran and Russia have solidified their post-2022 partnership, elevating it to the status of a comprehensive strategic partnership. The imperative to secure their borders and mitigate the impact of economic sanctions positions the South Caucasus and certain areas of the Caspian Sea as the focal points for deepening cooperation between Tehran and Moscow. Among the smaller regional actors, Azerbaijan is likely a primary beneficiary due to its geographically strategic location. Simultaneously, Russia may be inclined to reclaim some of its regional influence. This prospect is both precarious and potentially destabilizing for the region, as Russia’s historical engagement in the area has been characterized by conflict and disruptive interventions.

BACKGROUND: On January 17, Russia and Iran signed a Treaty on Comprehensive Strategic Partnership, marking the first high-level agreement between the two nations since 2001. Although historically characterized by tension and complexity, bilateral relations have undergone a significant transformation after 2022, in light of Russia’s war of aggression against Ukraine and its resulting international isolation. This period has seen a rapid elevation of Russian-Iranian ties, with some experts even suggesting the formation of an Entente.

The primary impetus behind this strengthening of relations lies in the challenges faced by both states. Politically isolated and subjected to extensive sanctions, Russia has become embroiled in a protracted and costly war. With limited strategic alternatives, Russian leadership has increasingly aligned itself with authoritarian regimes and internationally marginalized states—such as North Korea and Belarus—in an effort to mitigate the effects of its diplomatic and economic isolation and to secure critical military support.

Iran’s situation is arguably even more precarious. In addition to ongoing economic struggles and internal social unrest, Iran experienced a series of significant geopolitical setbacks between 2023 and 2024. At the end of 2024, the Tehran-backed regime of Bashar al-Assad was overthrown by the Turkish-supported opposition. Furthermore, the Israel-Hamas war inflicted severe damage on another of Iran’s key Middle Eastern proxies. These developments have reportedly exacerbated internal divisions within the Iranian political establishment, leading segments of Iran’s military-political elite to adopt a more critical stance toward Moscow.

Despite these disagreements, Russia and Iran remain compelled to act as close partners—if not outright allies—in the domains of defense and security, and perhaps even more so in trade and economic cooperation, as both seek to mitigate the detrimental effects of international sanctions. In this context, collaboration in the Caspian Sea region—particularly in specific areas of the South Caucasus—is expected to play a pivotal role in reinforcing Russo-Iranian ties.

IMPLICATIONS: The strengthening ties between Russia and Iran are expected to have a significant impact on the geo-economic landscape. As emphasized by Russian President Vladimir Putin, "the essence of the Treaty [between Russia and Iran] is about creating additional conditions [...] for the development of trade and economic ties. We need less bureaucracy and more action." This objective is explicitly outlined in Clause 13 of the Treaty.

At present, economic and trade cooperation between Tehran and Moscow remains limited. In 2024, the reported trade volume between the two countries did not exceed US$ 4 billion. However, this may change in the future, primarily due to Russia’s evolving geopolitical strategy. Given its significantly weakened global position after 2022, Moscow increasingly views Iran as its “window to Asia”—a crucial conduit for circumventing Western-imposed economic sanctions and mitigating their severe economic impact.

In pursuit of this objective, Russo-Iranian cooperation is expected to strengthen in two key domains. First, there will likely be an intensification of trade along the International North-South Transport Corridor (INSTC)—a 7,200-kilometer multimodal freight route encompassing ship, rail, and road networks that connects India, Iran, Azerbaijan, Russia, and Central Asia. The INSTC is increasingly regarded as a viable alternative to traditional maritime trade routes such as the Suez Canal and the Bosphorus Strait.

Within this framework, Azerbaijan stands to be a primary beneficiary, as its strategic geographic position between Iran and Russia will elevate its role as a crucial transportation hub, significantly enhancing its economic and geopolitical importance within the region.

Azerbaijan’s role could be further reinforced if the two countries proceed with the construction of a natural gas pipeline through Azerbaijani territory. Initially agreed upon in 2022 and reaffirmed in late 2024, this project represents a significant expansion of regional energy cooperation. In his most recent statement on January 17, 2025, Russian President Vladimir Putin announced that the proposed pipeline would have a capacity of 55 billion cubic meters (bcm) of natural gas—equivalent to the Nord Stream 1 capacity—and could potentially be extended to Pakistan and even India.

However, some Russian experts question the economic viability of the project, arguing that its feasibility remains uncertain. They suggest that the pipeline could serve as a political instrument for Russia to exert pressure on China, possibly as a means of persuading Beijing to strengthen its energy ties with Moscow. Nevertheless, if both the International North-South Transport Corridor (INSTC) and the gas pipeline are successfully implemented, the South Caucasus—and Azerbaijan in particular—will see a marked increase in geopolitical and economic significance as a critical Eurasian transportation and energy corridor.

Although defense and security are not the primary focus of the Russo-Iranian Treaty, as explicitly stated by Iran’s Ambassador to Russia, Kazem Jalali, certain shifts in the regional security landscape are nonetheless anticipated.

One key factor influencing these dynamics is the aftermath of the Second Nagorno-Karabakh War (2020), resulting in an undisputed victory for Azerbaijan which not only received strong backing from Turkey but also enjoyed tacit Russian support. This outcome significantly weakened Iran’s position in the South Caucasus, while simultaneously bolstering its strategic adversary, Turkey. In addition to consolidating its influence over Azerbaijan, Turkey also strengthened economic, political, and energy ties with both Azerbaijan and Georgia, marking a substantial geopolitical success for Ankara and further diminishing Tehran’s leverage in the region.

However, in the post-2022 period, the geopolitical landscape of the South Caucasus has undergone further transformations, creating additional common ground for Russo-Iranian cooperation. The increasing prominence of Turkey, which directly contradicts the strategic interests of both Russia and Iran, has been a key factor in this shift.

Simultaneously, Russia’s influence over both Armenia and Azerbaijan has weakened. Armenia’s signing of a Charter on Strategic Partnership with the U.S. implies a diversification of its geopolitical partnerships, potentially reducing Moscow’s leverage in Yerevan.

Moreover, by the end of 2024, anti-Russian sentiment became more pronounced in Abkhazia, a breakaway region that has been heavily reliant on Moscow. These developments have raised alarms among Russian analysts, some of whom have warned of Russia’s "approaching loss of the South Caucasus." While such statements may be premature and alarmist, they nonetheless reflect Moscow’s growing concerns regarding its long-term strategic foothold in the region.

Iran and Russia appear to prioritize a shared geopolitical objective: the de-Westernization of the South Caucasus and the prevention of strengthened U.S. regional influence. This strategic alignment is explicitly reflected in Clause 12 of the Russo-Iranian Treaty, which underscores both parties’ commitment to “strengthening peace and security in the Caspian Sea region, Central Asia, the South Caucasus, and the Middle East [to] prevent destabilizing interference by third parties” in these areas.

In this context, some experts suggest that Iran’s increased diplomatic involvement in regional affairs is likely. One potential avenue for such engagement is the "3+3" format, which includes Armenia, Iran, Russia, Georgia, Turkey, and Azerbaijan. Initially proposed by Ankara and Baku, the framework has since received active support from Moscow as a means to reduce the risk of Western powers gaining a foothold in the South Caucasus. Iran’s participation in this diplomatic initiative could further consolidate its regional influence while aligning with Russia’s broader strategic objectives.

CONCLUSIONS: The expansion of Russo-Iranian ties is expected to have a notable impact on the South Caucasus and parts of the Caspian Sea region. Azerbaijan's geo-economic and geopolitical significance is likely to increase further, particularly if economic sanctions against Russia remain in place, compelling Moscow to deepen its reliance on alternative regional partners.

Russia, whose regional standing is in decline, might unexpectedly benefit from Iran’s strategic weakening. Given its growing security concerns, Tehran may become more inclined to collaborate with Moscow in the South Caucasus and the Caspian Sea region to safeguard its strategic depth and border security.

From a broader strategic perspective, a greater Russian presence in the region should be viewed as a negative development. Given the region’s complexity and history of conflict, Russia’s potential increased involvement—if it materializes—poses a significant risk. Historically, Moscow’s regional policies have regularly contributed to greater instability rather than fostering long-term security, raising concerns about the potential destabilizing consequences of renewed Russian engagement in the South Caucasus and Caspian Sea region.

AUTHOR BIO: Dr. Sergey Sukhankin is a Senior Fellow at the Jamestown Foundation and the Saratoga Foundation (both Washington DC) and a Fellow at the North American and Arctic Defence and Security Network (Canada). He teaches international business at MacEwan School of Business (Edmonton, Canada). Currently he is a postdoctoral fellow at the Canadian Maritime Security Network (CMSN).

Armenia and Azerbaijan Reshape their Future through Direct Negotiation

By Robert M. Cutler

The year 2024 saw a shift away from external mediation in the Armenia–Azerbaijan conflict, to direct bilateral negotiations. Despite widespread expectations of a finalized peace treaty by the end of 2024, no agreement was signed. This reflects a strategic decision to avoid an interim settlement that could entrench unresolved provisions. Constitutional ambiguities in Armenia and bilateral territorial adjustments continue to shape the negotiation dynamics, raising questions about whether this diplomatic model will consolidate into a stable framework or remain in flux.

BACKGROUND: Since the 1994 Bishkek Protocol froze the conflict between Azerbaijan and Armenia over Nagorno-Karabakh in a fragile ceasefire regime under Russian sponsorship, mediation models had consistently prioritized multilateral equilibrium over durable resolution. The OSCE Minsk Group—formalized in December 1994 with the three co-chairs France, Russia, and the U.S.—institutionalized this status quo. In this diplomatic environment, negotiations served as an instrument for conflict management rather than conflict termination. The April 2016 Four-Day War briefly upended that architecture, demonstrating the latent instability embedded of the frozen-conflict model. Four and a half years later, the 2020 Second Karabakh War fundamentally restructured the region’s power balance. It rendered obsolete the externally imposed frameworks that had governed negotiations since the collapse of the Soviet Union.

The outcome of the 2020 war was the restoration of Azerbaijan’s control over the previously Armenian-occupied regions around the territory of the former (Soviet-era) Nagorno-Karabakh Autonomous Oblast. The Russian-brokered ceasefire of November 10, 2020, set the stage for a negotiation dynamic predicated on asymmetrical positioning. Armenia’s formal recognition of Azerbaijan’s territorial integrity in October 2022 (a move reportedly taken despite Kremlin opposition) implicitly signalled a shift that was not widely acknowledged at the time. Specifically, multilateral mediation lost its functional rationale; a new phase of direct engagement emerged. The replacement of Minsk Group arbitration, beginning with face-to-face negotiations in Brussels (May 2022), Prague (October 2022), and Munich (February 2023), was the logical conclusion of this trajectory.

The October 2022 Prague meeting marked the first sustained round of direct talks without the Minsk Group’s mediation. It encapsulated the recalibration of the regional conflict-resolution paradigm. The Armenia–Azerbaijan peace process has entered a structurally distinct phase, as direct bilateral diplomacy has replaced externally mediated negotiations. This is not merely a procedural transition. It is a fundamental shift in the conflict’s geopolitical management. For nearly three decades, external actors—principally Russia, the U.S., and the EU—had dictated the diplomatic framework while regional players remained constrained by inherited institutional architectures, notably the defunct OSCE Minsk Group.

IMPLICATIONS: The failure to finalize a peace treaty in 2024, despite reports that 90 percent of the agreement had been drafted, is not due to any diplomatic shortcoming. Rather, it represents a strategic recalibration. The logic behind avoiding an interim settlement is evident in historical analogues. For example, while the 1995 Dayton Accords successfully concluded the Bosnian War, institutionalized ethnic partitions persist as a structural impediment to governance nearly three decades later. To take another example, the 2015 Minsk II Agreement, designed to create a transitional settlement for the then-Donbas conflict, wound up embedding unresolved territorial issues in the political fabric. This subsequently facilitated Russia’s full-scale invasion of Ukraine in February 2022.

The deliberate avoidance of a prematurely finalized Armenia–Azerbaijan treaty suggests an awareness of these precedents. By declining to entrench provisions that might later serve as triggers of an unresolved structural conflict, the diplomatic system moves toward a “stable equilibrium” to replace the “local equilibrium” of the temporary cessation of hostilities. The elimination of substantive third-party mediation reinforces this shift.

Since October 2022, all consequential negotiations have been conducted bilaterally. External actors now function as logistical facilitators rather than as substantive arbiters. This pattern is comparable with, for example, the 1979 Egypt–Israel Peace Treaty, which—despite U.S. facilitation at Camp David—was fundamentally structured around direct negotiation and which has shown durability for over four decades. It contrasts with the 1993 Oslo Accords, which relied upon external assurances and ambiguous transitional mechanisms, and which collapsed amid shifting geopolitical realities. The Armenia–Azerbaijan framework thus increasingly resembles the former model, with bilateralization reinforcing sustainability. However, asymmetries within the process remain pronounced.

Azerbaijan has consistently employed a “position-setting” strategy, articulating clear demands and advancing specific legal-political objectives. This was evident in President Ilham Aliyev’s remarks at the February 2024 Munich Security Conference, where he characterized the negotiation process as a “one-sided dialogue” in which Azerbaijan proposes terms while Armenia refrains from active counter-positioning. This dynamic was illustrated also by the February 2024 withdrawal of Armenian forces from four Azerbaijani villages (Baghanis-Ayrum, Ashaghi Askipara, Kheyrimli, and Gizilhajili). This withdrawal was executed without a formalized reciprocal agreement, creating the perception that Azerbaijani proposals, rather than structured bilateral compromise, are the driving force in the conflict-resolution process.

The trial of Ruben Vardanyan, a key former figure in the Karabakh administration, further underscores Azerbaijan’s strategy of consolidating its post-2020 advantage through legal and political mechanisms. Vardanyan, arrested in September 2023 following Azerbaijan’s military operation in Karabakh, has been charged with financing terrorism and illegally crossing Azerbaijan’s border. His prosecution reflects a broader pattern of post-conflict legal adjudication, where Azerbaijan is systematically dismantling the institutional remnants of the former Karabakh authority while reinforcing its sovereignty claims over the region.

This judicial dimension introduces new considerations for the negotiation process. While Armenia has distanced itself from former Karabakh leadership figures, the trial raises concerns over how legal precedents set by Azerbaijan’s courts could influence broader diplomatic calculations. Precedents from post-war trials in Bosnia and Kosovo demonstrate that such cases can serve as mechanisms of conflict closure or as sources of prolonged diplomatic friction, depending on how they are leveraged within ongoing negotiations. Whether the trial is seen as a necessary legal process or as a strategic assertion of power will shape both Armenian domestic discourse and international perceptions of Azerbaijan’s post-war governance model.

An unresolved question about Armenia’s constitution remains a central point of contention. The constitution’s preamble makes reference to the 1990 Armenian Declaration of Independence, which in turn invokes the 1989 Soviet-era decision on the then–Nagorno-Karabakh, implicitly sustaining a legal framework that conflicts with Armenia’s 2022 diplomatic commitments. While Armenia contends that a treaty provision will supersede domestic law, Azerbaijan cites historical precedents in which Armenian legal rulings activated dormant constitutional clauses to justify policy reversals.

For example, the 2003 Armenian Supreme Court decision permitting Robert Kocharyan’s candidacy for president, despite constitutional residency requirements, exemplifies this phenomenon. Kocharyan, who had never officially resided in the Republic of Armenia prior to independence, was deemed eligible based on his prior residence in Nagorno-Karabakh during the Soviet and early post-Soviet period. This precedent reinforces Azerbaijan’s concerns regarding the durability of Armenian legal commitments, particularly given the requirement for a national referendum to amend the constitutional preamble—an event that will not take place before late 2026.

Historically, such delays have introduced windows of instability, where unforeseen political shifts disrupt anticipated diplomatic trajectories. The postponement of Palestinian legislative elections following the Oslo Accords, for example, contributed to the erosion of transitional governance structures, leading to subsequent escalations. The Armenia–Azerbaijan process now faces a comparable timeline-dependent risk, where protracted legal ambiguity could generate new friction points before formalized resolution mechanisms are enacted.

CONCLUSIONS: The bilateralization of diplomacy in the South Caucasus challenges the post-Soviet convention of externally managed equilibrium but has not yet cohered into a stable system. Whether the region consolidates into a sustainable post-conflict order or re-enters a phase of mediated arbitration depends not only on the resolution of uncertainties over the Armenian constitution, but also on unresolved territorial demarcations and the strategic recalibrations of external actors. The next 24 months will likely determine the trajectory of this diplomatic framework. Events between now and the end of 2026 will establish whether bilateral statecraft becomes institutionalized or whether it remains only an intermediary phase before external actors (not just Russia but also the EU and Iran) again seek to reassert dominant influence.

AUTHOR BIO: Robert M. Cutler was for many years a senior research fellow at the Institute of European, Russian and Eurasian Studies, Carleton University, and is a past fellow of the Canadian International Council.

India, Pakistan, and the South Caucasus Arms Race

By Syed Fazl-e-Haider

Pakistan and India, the longstanding rivals in South Asia, have instigated an arms race in the South Caucasus region. This development comes amid a broader arms supply deficit caused by Russia's preoccupation with the ongoing conflict in Ukraine. While India is deepening its military partnership with Armenia, Pakistan is enhancing the defense capabilities of Azerbaijan. Both states are actively seeking to fill the vacuum in arms procurement left by Russia's reduced presence in the region. India has aligned with Armenia, leveraging this partnership to pursue strategic connectivity projects in the South Caucasus. Conversely, Pakistan views Azerbaijan as a strategic ally, with their collaboration deemed essential for countering India in the competition for regional influence.

BCKGROUND: India and Pakistan have shared a contentious relationship since their emergence as independent states in 1947. The two states have engaged in three full-scale wars, primarily over Kashmir, a territory claimed by both. In 1998, Pakistan conducted nuclear tests shortly after India, marking a significant escalation in their rivalry. This ongoing antagonism often manifests in international forums, where the two countries accuse each other of fostering cross-border terrorism. Their rivalry extended to the South Caucasus in 2020, during the 44-day war between Armenia and Azerbaijan over the disputed Nagorno-Karabakh region.

Pakistan supported Azerbaijan during the Second Karabakh War in 2020. However, the close relationship between the two countries predates this conflict, with their cordial ties dating back to Azerbaijan's independence in 1991, following the dissolution of the Soviet Union. Pakistan was among the first nations to recognize Azerbaijan's independence, second only to Türkiye. After Armenian forces attacked Azerbaijan's Nagorno-Karabakh region shortly after its independence, both Türkiye and Pakistan strongly condemned Armenia's actions. Since then, they have consistently supported Azerbaijan’s position on the Nagorno-Karabakh issue in international forums, both politically and diplomatically. Pakistan has gone so far as to refrain from recognizing Armenia, refusing to establish diplomatic relations with the country. In return, Azerbaijan has endorsed Pakistan’s stance on the Kashmir dispute, a position that has antagonized India.

During the Second Karabakh War in 2020, Islamabad was alleged to have sent military advisers to support Azerbaijan. Armenian Prime Minister Nikol Pashinyan even claimed that Pakistani soldiers were actively fighting alongside the Azerbaijani army against Armenia during the 44-day conflict over Nagorno-Karabakh. Pakistan, however, categorically dismissed these allegations, labeling them as "baseless and unwarranted." Ultimately, Azerbaijan emerged victorious in the six-week war over the disputed region.

Türkiye strongly backed Pakistan's position on Kashmir, reciprocating Pakistan’s unequivocal support for Azerbaijan during the Karabakh war. The mutual endorsements of Islamabad's stance on Kashmir by Ankara and Baku provoked concern in New Delhi. Pakistan’s support for Azerbaijan during the conflict played a pivotal role in fostering closer ties between India and Armenia in the aftermath of the war. Observing its rival’s activities during the Karabakh conflict, India responded by significantly enhancing its defense partnership with Armenia over the subsequent four years.

Meanwhile, Azerbaijan, Pakistan, and Türkiye formalized their alliance by signing the Trilateral Islamabad Declaration in 2021, underscoring their solidarity with Azerbaijan in the aftermath of the war.

IMPLICATIONS: The supply of military equipment by India and Pakistan has significantly reduced Azerbaijan's and Armenia's dependence on Russia for weapons and ammunition. Historically, both South Caucasian nations relied heavily on Russia for defense supplies, particularly in the period preceding the 2020 Karabakh War. Between 2011 and 2020, Russia accounted for 94 percent of Armenia's major arms imports, including armored personnel carriers, air defense systems, multiple rocket launchers, and tanks. Similarly, Azerbaijan depended extensively on Russian military supplies during the same period, purchasing armored vehicles, air defense systems, Smerch rockets, transport and combat helicopters, artillery, multiple rocket launchers, and tanks.

India considers Armenia a strategic partner in the South Caucasus and has consequently deepened its military ties with Yerevan. Armenia has emerged as the largest foreign recipient of Indian weapons, with defense contracts concluded since 2020 estimated at US$ 2 billion. According to a report by the Indian Ministry of Finance, Armenia has become the leading importer of Indian arms, securing deals for the purchase of Pinaka multiple-launch rocket systems and Akash anti-aircraft systems. This development reflects a significant realignment in the defense landscape of the region.

In September, Azerbaijan formally introduced Pakistan’s fourth-generation JF-17 Thunder Block III fighter jets to its air force, marking a significant milestone in defense cooperation between the two nations. This development followed a US$ 1.6 billion agreement signed in February for the acquisition of JF-17 Block III aircraft. The deal includes not only the supply of aircraft but also ammunition and pilot training provided by Pakistan. The advanced combat capabilities of the JF-17 Block III are expected to enhance Azerbaijan's military edge in the South Caucasus. Notably, Azerbaijan has requested 60 JF-17 jets, intended to replace its entire fleet of aircraft, making this the largest defense export deal in Pakistan’s history.

The defense agreements between India and Armenia, as well as those between Pakistan and Azerbaijan, have significantly diminished Russia’s position as the principal supplier of weapons and ammunition to the South Caucasian nations. This shift has been exacerbated by Russia’s ongoing war in Ukraine, which has undermined its ability to deliver weapons in a timely manner under previously signed contracts. The entry of India and Pakistan into the regional defense market has provided Armenia and Azerbaijan with an opportunity to diversify their military procurement, reducing their historical reliance on Russian defense supplies.

The entry of India and Pakistan into the South Caucasus has resulted in the formation of two rival blocs competing for regional influence. One alliance, referred to as the Three Brothers, comprises Azerbaijan, Türkiye, and Pakistan, while the opposing group includes Armenia, Iran, France, and India.

For India, Armenia holds strategic importance as a potential bridge to access the vast market of the Eurasian Economic Union (EAEU). New Delhi views Armenia as a vital transit hub for connecting Indian goods to EU countries and envisions its role in facilitating bilateral or multilateral partnerships with nations such as Iran, France, and Greece to implement strategic connectivity projects in the South Caucasus.

Conversely, Islamabad considers its partnership with Azerbaijan critical for countering India's influence in the region. Azerbaijan has also emerged as a key player in the energy transit corridors connecting the Black Sea, South Caucasus, and Europe, further enhancing its geopolitical significance. This dynamic positions Azerbaijan as a strategic ally for Pakistan, particularly in the context of their shared interests in limiting India's regional ambitions.

CONCLUSIONS: Pakistan's defense cooperation with Azerbaijan and India's arms sales to Armenia are shaping new security dynamics that link the South Caucasus and South Asia. The extensive defense contracts between India and Armenia are poised to strengthen Armenia's position as a strategic ally for India in the region.

India's military partnership with Armenia is influenced by its geopolitical rivalry with Pakistan, which is actively supporting Azerbaijan's defense capabilities. Both Pakistan and India aim to secure reciprocal cooperation from the South Caucasian nations to advance their strategic interests. For Pakistan, Azerbaijan holds particular importance as a potential partner in trans-regional energy cooperation, given Pakistan's energy deficiencies. Azerbaijan's pivotal role in the energy transit corridor connecting South Asia and the South Caucasus further underscores this strategic alignment.

Conversely, India, as an observer in the Eurasian Economic Union (EAEU), is working to deepen its cooperation with Armenia across economic sectors, with a particular emphasis on defense. Armenia's strategic position could also facilitate India's broader connectivity initiatives with Europe. Meanwhile, Pakistan is likely to leverage its relationship with Azerbaijan to counterbalance India's growing influence in the region, highlighting the interconnected and competitive geopolitical landscape of the South Caucasus and South Asia.

AUTHOR’S BIO: Syed Fazl-e-Haider is a Karachi-based analyst of the Wikistrat. He is a freelance columnist and the author of several books. He has contributed articles and analysis to a range of publications. He is a regular contributor to Eurasia Daily Monitor of Jamestown Foundation.

Silk Road Paper S. Frederick Starr,

Silk Road Paper S. Frederick Starr,  Book Svante E. Cornell, ed., "

Book Svante E. Cornell, ed., "