The “Inkai Incident”: Under the Surface of Kazakhstan’s Uranium Production

By Sergey Sukhankin

In early January 2025, operations at the uranium-producing Kazakhstan-based Joint Venture Inkai LLP (JV Inkai) were temporarily halted – the venture, established in the early 1990s, has been jointly managed by Kazatomprom (which holds a 60 percent stake) and the Canadian company Cameco (with 40 percent) – resulting in a brief decline in the share prices of both firms in New York and evident concern among Canadian investors. After a short interruption, activities at Inkai resumed without disruption. This event – though seemingly a minor occurrence that largely escaped the attention of many analysts – reflects broader and more concerning trends (particularly for the West) emerging within the global uranium market, in which Kazakhstan plays a pivotal role.

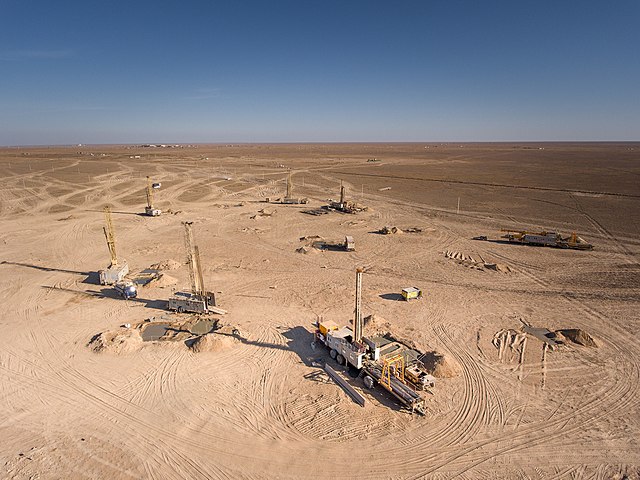

Photo source: NAC Kazatomprom JSC

BACKGROUND: The strategic significance of uranium extends well beyond its military applications. The rapidly increasing global interest in nuclear energy—among both economically advanced and developing countries—is contributing to uranium’s emergence as a commodity of critical strategic value. According to estimates by the International Energy Agency (IEA), in addition to the existing 420 nuclear reactors worldwide, 63 new reactors are currently under construction, and the operational lifespan of a further 60 reactors is being extended. As a result, uranium's importance is projected to grow steadily in the years ahead. The present and future stability of the global nuclear energy sector is therefore highly contingent upon reliable access to substantial, readily extractable uranium reserves located in politically stable and predictable nations. It is precisely in this context, however, that significant challenges begin to surface.

Following the onset of Russia’s aggression against Ukraine in February 2022, Western access to two critical sources of both enriched and unenriched uranium has been partially obstructed. U.S. sanctions targeting Russian uranium have jeopardized U.S. access to this supply, while geopolitical instability—marked by a pronounced anti-Western orientation—in Sub-Saharan Africa, particularly in Niger, has effectively severed France’s access to locally sourced unenriched uranium. Exacerbating this situation, other major African uranium producers, including Namibia and Tanzania, are increasingly inclined to cooperate with Russia and China in uranium extraction activities. This emerging alignment places them in growing opposition to Western companies and their strategic interests.

At present, the already limited list of geopolitically stable, world-class uranium-producing nations has effectively narrowed to just three: Kazakhstan, Canada, and Australia. Among them, Kazakhstan stands as the global leader in the production of unenriched uranium, accounting for over 40 percent of total global output, and ranks as the second-largest country in terms of uranium reserves.

The primary concern lies in the fact that, despite its considerable wealth in natural resources, Kazakhstan is unable to fully leverage its vast resource potential. The country remains heavily dependent on two dominant geopolitical actors—Russia and China—both of which exert significant influence over the direction and development of Kazakhstan’s uranium-producing sector. Most critically, these two states maintain increasingly strained relations with the West.

Consequently, certain Kazakhstan-based analysts have voiced suspicions that the underlying cause of the operational halt at Inkai was pressure exerted by Russia, allegedly in response to Kazakhstan’s post-2022 efforts to alter the logistics of its uranium exports by decreasing reliance on Russian transit routes and instead utilizing the Trans-Caspian International Transport Route (commonly referred to as the Middle Corridor) as an alternative to exporting uranium through Russian territory.

IMPLICATIONS: The global uranium industry is currently characterized by rapidly increasing demand alongside growing uncertainty regarding the reliability of supply, driven largely by global and regional geopolitical disruptions. Within this context, Kazakhstan’s role as a resource-rich and historically stable supplier of uranium has acquired a qualitatively new significance. Notably, Kazakh authorities have publicly committed to boosting uranium production in 2025 and to diversifying both their export destinations and logistical routes, aiming to reduce the country's reliance on Russia. Nevertheless, the “Inkai incident”—which allegedly represents only the visible portion of deeper structural dynamics affecting Kazakhstan’s uranium sector—raises three key concerns.

First, can Kazakhstan successfully restructure its existing logistical routes and thereby reduce its strategic dependence on Russia? On the surface, such a shift appears feasible. According to statistics provided by Kazakh authorities, the country has made tangible progress in increasing uranium shipments through the Middle Corridor. Available data indicate that approximately 64 percent of West-bound uranium exports are now transported via this route. Moreover, Kazakhstan has also expanded its uranium exports to Western markets, with shipments destined for the United States gaining particular prominence.

The reality, however, appears significantly more complex. Despite recent efforts to diversify transit routes, a substantial portion of Kazakhstan’s uranium exports continues to be transported through Russian territory. Furthermore, Russia’s state-owned corporation Rosatom maintains (in)direct control over at least five of Kazakhstan’s fourteen major uranium production sites, reinforcing Russia’s strategic influence over the sector. In addition, the Middle Corridor presents notable challenges. Geopolitically, Georgia—an essential transit country along the route—occupies a critical position, and its political leadership has demonstrated increasing alignment with Moscow, potentially complicating matters should Russo-Western relations further deteriorate. From a logistical standpoint, representatives of the Canadian firm Cameco have expressed concerns, stating that the Middle Corridor “has proven to be neither reliable nor predictable,” due to the complex network of countries traversed and the numerous permits required for transit.

Compounding these challenges is the apparent ambivalence within Kazakhstan regarding the exclusion of Russia from its current uranium transportation framework. Specifically, Kazakh officials have indicated that the country does not intend to significantly expand the use of the Middle Corridor for uranium exports. Additionally, many Kazakhstan-based experts express skepticism about any prospective reduction in cooperation with Rosatom (i.e., Russia). On the contrary, a prevailing view among these analysts is that bilateral collaboration in the uranium sector is likely to deepen in the future.

Second, what is the actual role of China in Kazakhstan’s uranium industry and how will this role evolve? At present, China is the world’s second-largest consumer of uranium, following the United States, and its demand is expected to continue rising. Kazakhstan serves as China’s primary source of uranium: according to several studies, over half of Kazakhstan’s uranium output is currently exported to China, with some estimates suggesting this figure may be as high as 60 percent. This situation, as noted by representatives of major Western uranium-related enterprises, “raises concerns about reduced availability for Western markets, potentially exacerbating global supply constraints,” a challenge that is already beginning to manifest within the industry.

Rosatom-affiliated Uranium One Group recently concluded an agreement with the Chinese firm SNURDC Astana Mining Company Limited, a subsidiary of the State Nuclear Uranium Resources Development Co., Ltd. Under this arrangement, the Russian side transferred its shares in uranium-producing sites located in Northern Kazakhstan (Northern Khorasan) to its Chinese counterparts. At present, there is no consensus among experts regarding China’s rationale for acquiring stakes in what is considered a relatively depleted and comparatively minor uranium production site.

While some analysts contend that the acquisition primarily serves China’s geoeconomic objectives—particularly in light of projections indicating a substantial increase in the country’s uranium consumption over the coming years—others emphasize a more overtly geopolitical dimension to China’s actions. Notably, Stanislav Pritchin of the Central Asia Department at the Institute of World Economy and International Relations of the Russian Academy of Sciences has drawn attention to China’s established practice of acquiring “unpromising” oil and natural gas deposits. In his view, such acquisitions function as instruments for expanding China’s strategic presence within the host country.

Third, what is the future role of Western companies in Kazakhstan’s uranium industry? Given that neither China nor Russia appears willing to reduce their involvement in the sector—thereby sustaining Kazakhstan’s strategic dependency on both actors—serious concerns have emerged regarding the potential marginalization or even eventual withdrawal of Western firms from the country’s uranium landscape. Indeed, some Kazakhstan-based experts have implicitly acknowledged a widely discussed notion circulating in Western policy and business circles: the ongoing bifurcation of the global uranium industry. This refers to the emergence of a distinct segmentation of uranium supply chains along geopolitical lines, with one stream aligned with the West and the other with the China-led bloc. Within this context, it is feared that Kazakhstan may ultimately be compelled to align more closely with the latter and reduce its cooperation with Western partners accordingly.

Undoubtedly, such a scenario would only be likely to materialize in the event of a further deterioration in political and economic relations between China (and, under certain conditions, Russia) and their Western counterparts. While this scenario remains hypothetical at present, it is by no means implausible.

CONCLUSION: Although Kazakhstan and its political leadership have expressed strong interest in expanding foreign—particularly Western—participation in the country’s uranium industry, the influence of external geopolitical dynamics cannot be overlooked. As uranium increasingly assumes a role in the global energy mix comparable to that historically occupied by fossil fuels, the issue of access to and supply of this resource has transcended purely economic considerations and has firmly entered the realm of geopolitics.

In light of the intensifying geopolitical competition between East and West over access to emerging markets and spheres of influence, it is conceivable that China and its strategic partners may seek to curtail Western access to Kazakhstan-based uranium—mirroring developments in Sub-Saharan Africa, where Western firms are increasingly being displaced from uranium-related ventures. To avert a potential supply shock—akin to that experienced in the oil and natural gas sector following Russia’s attempt, in the aftermath of February 2022, to weaponize hydrocarbon exports as a means of exerting geopolitical pressure on the West—it is imperative that Western companies (and, arguably, governments) begin to explore alternative uranium sources to sustain their nuclear energy agendas. Given the small number of globally significant suppliers, increased attention should be directed toward Canada and Australia, which possess substantial uranium reserves and are regarded as geopolitically stable and reliable partners.

AUTHOR BIO: Dr. Sergey Sukhankin is a Senior Fellow at the Jamestown Foundation and the Saratoga Foundation (both Washington DC) and a Fellow at the North American and Arctic Defence and Security Network (Canada). He teaches international business at MacEwan School of Business (Edmonton, Canada). Currently he is a postdoctoral fellow at the Canadian Maritime Security Network (CMSN).

Tokayev's Tightrope: Kazakhstan's Balancing Act in a Shifting World

By Anna Harvey

In a January 2025 interview with Ana Tili newspaper, Kazakhstan's President Kassym-Jomart Tokayev outlined his vision of Kazakhstan as a middle power balancing relations between global powers while pursuing domestic reforms. The analysis examines how Tokayev has moved to separate himself from his predecessor, Nursultan Nazarbayev, implementing constitutional changes, economic reforms, and foreign policy shifts following the January 2022 events, while facing the complex challenge of maintaining independence from both Russian and Chinese influence. Tokayev’s leadership marks a new stage of Kazakhstan’s development, positioning the country as an independent player on the global stage.

Photo by Vladimir Tretyakov

BACKGROUND: On January 3, 2025, the President of Kazakhstan Kassym-Jomart Tokayev gave a written interview with Ana Tili newspaper reflecting on 2024 and discussing Kazakhstan’s future. In the interview, Tokayev emphasized Kazakhstan's role as a "middle power" globally; its ties with the U.S., Russia, and China; Nazarbayev's legacy; economic development; and Kazakhstan's future goals. He also addressed the "January events," the January 2022 mass protests against gas prices that turned into an intra-elite fight and escalated into riots and violence.

In international politics, Tokayev expressed pride in Kazakhstan's "middle power" status, stating the country should "work collaboratively to build new, resilient bridges between conflicting geopolitical poles. Kazakhstan maintains support for the UN and other international organizations. Tokayev expressed optimism about relations with both the U.S. and China, noting Kazakhstan's willingness to support Washington regarding Ukraine and plans for extensive high-level dialogue with Beijing in 2025.

Regarding the former president, Tokayev characterized Nazarbayev's legacy as overwhelmingly positive and noted their strong relationship, including monthly phone calls. Despite his own efforts to reduce Russian influence in Kazakhstan, Tokayev expressed no concern about Nazarbayev's December meeting with Putin, describing such meetings as exchanges between "long-time friends and colleagues with much to reminisce about."

On the economic front, Tokayev praised Kazakhstan's progress while noting that "economic growth of 4 percent is insufficient." Rather than artificially holding exchange rates or micromanaging sectors, he stated his belief that the government should "ensure the stability and efficiency of the economy, the dynamic development of the real sector, growth in labor productivity, and the creation of high-quality jobs." He also supports recovering illegally obtained assets for reinvestment in education, infrastructure, and social needs.

Domestically, Tokayev highlighted extensive modernization projects in housing, roadways, railways, industry, and education. He also discussed the expansion of Kazakhstan’s social state: in 2024, the government began the National Fund for Children, where 50% of investment income from the National Fund of Kazakhstan will go to children's savings accounts for housing or education after age 18. Additionally, pensions, academic scholarships, and civil servant salaries were increased. Tokayev also emphasized his government's rapid response to spring 2024 flooding and efforts to build a "Clean Kazakhstan" through environmental initiatives.

In response to a question about the January events, Tokayev affirmed that, had decisive actions “not been taken against the instigators of the riots and organizers of the coup, Kazakhstan today would be a very different country, with diminished independence and restricted sovereignty.” The January events in question began on January 1, 2022, and began as protests against hikes in energy prices in western Kazakhstan. These protests appeared to be co-opted into an intra-elite struggle pitting parts of Nazarbayev’s entourage, specifically in the security structures, against Tokayev’s government, and spiraled into violent riots. Tokayev responded by requesting peacekeeping forces from the Collective Security Treaty Organization (CSTO) be deployed to suppress the rioters. In total, around 238 people were killed. Since the riots, Tokayev has used the memory of the events to support a number of governmental reforms, including strengthening the powers of parliament over the presidency. In his interview, the President encouraged citizens not to fall victim to disinformation related to the riots, and he later stated evidence of involvement from criminal groups in the January events was a driving force behind his efforts to strengthen law and order in Kazakhstan, a project labeled “Just Kazakhstan.”

IMPLICATIONS: Tokayev's interview reveals his continued efforts to establish an independent identity from his predecessor. Initially, Tokayev was depicted as largely a figurehead acting on behalf of Nazarbayev, in spite of clear indications that he was assertively pushing a reformist agenda against the resistance of elements of the “old guard.” Following the January 2022 events, he has made significant breaks from Nazarbayev's legacy through constitutional reforms, including stripping Nazarbayev's title of “Elbasy” (or national patriarch) and removing immunity protections for his family.

Further changes include increasing Kazakhstan’s presence on the world stage and decreasing reliance on Russia. Kazakhstan's “positive balance” policy (initially promoted by Tokayev in 1997, when he was Foreign Minister) has gained new significance, particularly following Russia's invasion of Ukraine. Tokayev’s condemnation of the invasion, acceptance of Russian draft evaders, and pursuit of alternative pipelines have established Kazakhstan as a middle power outside Russia's sphere of influence. Regionally, Kazakhstan has increased its influence through initiatives like the Turkic World Vision-2040 program.

Kazakhstan is Central Asia's largest economy ($261.4M GDP in 2023). Under Tokayev, the country is actively diversifying away from Russian and Chinese influence, especially as a result of Russia’s damaged reputation following the invasion of Ukraine and public skepticism toward Chinese business practices. Seeking alternatives, Kazakhstan has successfully attracted Western investment, particularly from the United States ($65B invested), which sees Kazakhstan as a potential alternate rare-earth supplier and strategic partner in the region.

CONCLUSIONS: President Tokayev has evolved beyond his initial role as Nazarbayev's chosen successor, building a distinct legacy as revealed in his Ana Tili interview. His vision for Kazakhstan's future emphasizes its role as a middle power, balancing engagement with the United States, European Union, Russia, and China to maintain political and economic sovereignty. Under his leadership, Kazakhstan has strengthened its position by expanding regional ties and diversifying its interests beyond Russia and China.

However, significant challenges remain. Kazakhstan must navigate complex domestic power dynamics, including potential resistance from remaining elements of the old guard and public discontent, especially regarding economic opportunities. Meanwhile, Russia continues to pressure Kazakhstan to limit its independent foreign policy, while public skepticism of Chinese influence constrains economic partnerships. The success of economic diversification and domestic reforms will depend on Tokayev's ability to manage these internal and external pressures while maintaining Kazakhstan's sovereignty.

AUTHOR’S BIO: Anna Harvey is a Researcher at the Central Asia and Caucasus Institute and the American Foreign Policy Council. She received a Master of Arts in Russian, East European, and Eurasian Studies from Stanford University. She has written for Newsweek, the U.S. Army War College War Room journal, and Postimees newspaper.

Reinterpreting Kazakhstan as a "Middle Power"

By Rafis Abazov

Kazakhstan has long sought to establish itself as a "middle power" in Eurasia, though its geographic and political significance has often been overshadowed by rivalries among major powers like Russia, China, and the West. Recent developments—such as the rise of Central Bank Digital Currencies (CBDCs), expanded Eurasian transport links, and deeper global economic integration—offer new opportunities to realize this ambition. These themes were explored at the Kazakhstan Economic Freedom Conference held in Astana in September 2024, where experts debated whether Kazakhstan can effectively capitalize on these trends to enhance its global standing.

BACKGROUND: In international relations, a "middle power" refers to a state that, while not a superpower, exerts significant regional influence and acts as a bridge between larger global powers. Kazakhstan, Central Asia's largest economy with a GDP of US$ 261 billion (2023), has pursued this status through a strategy of balancing relations with major neighbors like Russia and China while fostering strong ties with the West. Astana emphasizes principles of non-alignment and multivector diplomacy, enabling the country to mediate regional conflicts, support global non-proliferation, and contribute actively to international organizations. Kazakhstan’s vision as a middle power is rooted in its economic potential, particularly its vast reserves of oil, gas, and minerals, which have attracted substantial foreign investment over the past three decades. This influx of investment has supported infrastructure development and economic diversification, bolstering its regional standing. By leveraging its natural resources, strategic geographic position, and diplomatic engagement, Kazakhstan aspires to shape regional and global dynamics. Nevertheless, as global economic systems and technological innovations transform the international landscape, Kazakhstan’s ability to adapt and capitalize on these changes will be crucial in achieving its middle-power ambitions.

IMPLICATIONS: Three key developments hold the potential to bolster Kazakhstan’s status as a middle power, with one of the most transformative being the rise of CBDCs. As digital equivalents of national currencies issued by central banks, CBDCs promise to revolutionize global financial systems by improving transactional efficiency, strengthening monetary policy, and significantly reducing the costs of cross-border payments. Kazakhstan is actively examining the potential of CBDCs, drawing lessons from countries like China, which has advanced in developing the digital yuan. For Kazakhstan, adopting a CBDC could modernize its financial infrastructure, enhancing its integration into global and regional financial networks. A national CBDC would not only streamline domestic payment systems but also facilitate faster, cheaper, and more secure international transactions. This shift could play a pivotal role as Kazakhstan seeks to diversify its economy beyond oil and gas, attracting foreign direct investment in emerging sectors such as advanced technology, green energy, and financial services. Additionally, a CBDC would enable Kazakhstan to exercise greater control over its monetary system, reducing reliance on foreign currencies in trade and cross-border finance. Amid increasing geopolitical tensions and the impact of sanctions on global trade flows, such autonomy within a digital financial ecosystem could significantly enhance Kazakhstan’s economic resilience and reinforce its strategic positioning as a middle power. The second key development bolstering Kazakhstan's middle-power aspirations is its role in bridging East and West. Strategically located at the center of Eurasia, Kazakhstan has long been pivotal in regional transportation and logistics. This role is being strengthened by the expansion of Eurasian transportation corridors, particularly the 4,200-km Trans-Caspian International Transport Route (TITR). Positioned at the intersection of major trade routes connecting Europe, Asia, and the Middle East, Kazakhstan's importance has grown amid disruptions in global supply chains caused by geopolitical tensions, the COVID-19 pandemic, and shifting trade partnerships. Initiatives such as China’s One Belt, One Road (OBOR) project further underscore Kazakhstan’s centrality in facilitating overland trade between China and Europe. Investments in infrastructure—including railways, highways, and ports—enhance Kazakhstan’s potential to capture a larger share of international trade flows, boosting its economy and geopolitical relevance. Discussions at the Astana conference highlighted how these transportation corridors present a critical opportunity for Kazakhstan to redefine its middle-power role. By strengthening economic ties with major global actors such as China, the European Union, and Turkey, Kazakhstan not only solidifies its position as a regional logistics hub but also enhances its capacity as a mediator. This dual role, connecting East and West through both trade and diplomacy, reinforces Kazakhstan’s strategic standing in an increasingly interconnected world. The third development shaping Kazakhstan’s aspirations as a middle power is its integration into the global economy amidst ongoing global shocks. Like many nations, Kazakhstan has faced significant economic disruptions in recent years due to the COVID-19 pandemic, geopolitical conflicts, and environmental crises. Mark Uzan, director of the Reinventing Bretton Woods Committee and co-organizer of the Astana conference, noted that these shocks have disrupted global supply chains, heightened financial market volatility, and altered trade patterns. They have also exposed vulnerabilities in Kazakhstan’s economic model, particularly its reliance on natural resource exports. Kazakhstan’s response to these challenges has been twofold. Domestically, the government has emphasized economic diversification, with investments in renewable energy, agriculture, and digital technologies. Internationally, Kazakhstan has pursued deeper integration into global and regional economic systems, including active participation in the Eurasian Economic Union (EAEU), China’s Belt and Road Initiative (BRI), and the World Trade Organization (WTO). The Astana conference underscored the urgency for Kazakhstan to accelerate its diversification efforts and strengthen resilience to external shocks. Policies promoting advanced technology transfer, improved governance, and enhanced participation in global value chains were identified as critical steps. Successfully navigating these challenges could not only stabilize Kazakhstan’s economy but also enhance its credibility and influence as a middle power on the global stage.

CONCLUSIONS: At the international conference in Astana, experts emphasized the transformative potential of CBDCs in positioning Kazakhstan as a financial hub in the region and a key player in the emerging digital economy. By adopting CBDCs and advancing digital finance, Kazakhstan could assert itself as a middle power by actively shaping global financial norms and practices. Moreover, integrating regional transportation corridors with technologies like blockchain and digital logistics platforms could improve efficiency and transparency in trade, giving Kazakhstan a competitive edge. With strategic control over vital transportation routes and a commitment to digital innovation, Kazakhstan is well-positioned to influence the reconfiguration of global trade networks in the 21st century. Kazakhstan’s rise as a middle power should therefore be reinterpreted beyond its diplomatic and geopolitical role, focusing on its capacity to navigate and shape the regional economic order. The interplay of CBDC adoption, transportation network expansion, and integration into regional and global economic systems creates new pathways for Kazakhstan to enhance its influence on the international stage. However, Kazakhstan’s ability to secure middle-power status will depend on well-calibrated economic policies that address internal challenges while responding to global economic, technological, and geopolitical shifts. The conference underscored the importance of embracing digital finance, expanding its transportation hub role, and building economic resilience. By doing so, Kazakhstan can solidify its position as a pivotal actor in the future of the Eurasian region and the global economy.

AUTHOR’S BIOS: Rafis Abazov, PhD, is a director of the Institute for Green and Sustainable Development at Kazakh National Agrarian Research University. He is the author of The Culture and Customs of the Central Asian Republics (2007) and The Stories of the Great Steppe (2013). He was executive manager for the Global Hub of the United Nations Academic Impact (UNAI) on Sustainability in Kazakhstan between 2014 and 2019 and organized the International Model UN New Silk Way conference in Afghanistan in 2014 and 2015. He served as a UNDP project manager (joint project UNDP, FAO, and UNICEF) between 2019 and 2022.

Kazakhstan's First NPP: Economics and Geopolitics

By Sergey Sukhankin

In Kazakhstan’s recent referendum, over 71 percent of voters endorsed building the country’s first nuclear power plant (NPP), marking a significant step toward advancing this major infrastructure project. Strongly supported by President Kassym-Jomart Tokayev and the national political elite, the NPP is expected to address Kazakhstan’s current and projected electricity needs. Additionally, as the world’s leading uranium producer, Kazakhstan stands to benefit from self-sufficiency in uranium enrichment, reducing its reliance on external suppliers. A key issue now centers on which entity will secure the NPP construction contract, with geopolitical considerations expected to weigh heavily alongside technological and economic factors.

BACKGROUND: Discussions about constructing a new, modern NPP in Kazakhstan date back to the early 2000s. From 1973 to 1999, the country operated an NPP in Shevchenko (now Aktau), which was closed as part of Kazakhstan’s de-nuclearization policy. However, tangible steps toward this goal only began in 2021, following a severe electricity shortage linked to a spike in cryptocurrency mining and pressures from the COVID-19 pandemic. At the same time, the European Union’s push for sustainable trade relations led Kazakhstani political leaders to prioritize renewable energy expansion in the national economy. In promoting a public vote for constructing an NPP, the government highlighted four main priorities: averting a potential energy crisis amid rising electricity demand; mitigating environmental risks linked to unsustainable energy sources; reducing Kazakhstan's reliance on electricity imports from Russia; and preserving the competitiveness of Kazakh exports to the EU. Despite compelling arguments supporting the nuclear power plant project, significant concerns have emerged from local experts, civil society, and the public. A primary worry centers on the risk of nuclear accidents, with Chernobyl and Fukushima serving as stark reminders of possible environmental catastrophes. Specific fears include potential harm to the fragile ecosystem of Lake Balkhash, which is already experiencing drying and may face further degradation from plant operations. Moreover, experts emphasize Kazakhstan's current lack of expertise and infrastructure for safely managing nuclear waste, leaving the issue of radioactive waste disposal unresolved. The economic viability of Kazakhstan's nuclear project is also a subject of concern. Critics point to the high construction costs and question the plant’s long-term financial sustainability, especially given the uncertain outlook for future electricity demand. Some experts suggest that the expected surge in demand may not occur as projected. They argue that even if demand does rise, Kazakhstan has alternative options, such as expanding renewable energy sources and improving the efficiency of the current electricity grid, which could address energy needs without relying on nuclear power. Geopolitical concerns further drive opposition to Kazakhstan’s nuclear project. Recent incidents at nuclear facilities, such as Zaporizhzhia and Kursk, illustrate the vulnerability of such infrastructure during conflicts, highlighting risks if similar instability arises in Central Asia. Additionally, Kazakhstan’s limited technical expertise and financial resources mean it would likely depend heavily on foreign partners to build and operate the plant. Critics argue that this reliance could compromise Kazakhstan’s sovereignty, with potential implications for the country’s long-term energy autonomy and geopolitical independence.

IMPLICATIONS: Four main contenders have emerged to construct Kazakhstan’s NPP: Russia’s Rosatom, China’s National Nuclear Corporation (CNNC), Korea Hydro and Nuclear Power (KEPCO), and France's Électricité de France (EDF). While Kazakhstan has pledged to base its choice on factors such as economic feasibility, technological reliability, and environmental safety, Russia and China realistically lead the race. Although France and South Korea bring significant expertise, high construction costs (potentially exceeding US$ 12 billion) and geopolitical dynamics may limit their competitiveness. Thus, Kazakhstan appears to face three pragmatic options moving forward. One option is for China to assume the role of sole contractor for the project, a scenario with several competitive advantages. China offers relatively lower construction costs compared to French and South Korean alternatives and maintains a robust trade and investment relationship with Kazakhstan, enhancing its influence as an economic partner. However, the feasibility of China proceeding alone is uncertain. Moscow might perceive China’s unilateral role as a diplomatic slight, as Russia has become a key strategic partner and potential Arctic access point for China. Moreover, it remains unclear if China is willing or prepared to undertake this project independently, given its geopolitical sensitivities. A second option is to appoint Russia as the sole contractor, a role Moscow has long pursued. Between 2010 and 2019, President Vladimir Putin personally lobbied Kazakhstan to select Rosatom as its nuclear plant builder. Given Russia’s current geopolitical isolation and diminishing network of allies, Moscow might view any exclusion of Rosatom as a serious diplomatic offense. The recent “grain war” between Russia and Kazakhstan—allegedly sparked by Kazakhstan’s refusal to join BRICS—demonstrates how swiftly Moscow might respond with retaliatory measures if it perceives a breach in loyalty or alignment. An analysis of Russian sources indicates several strategies Russia might use to “encourage” Kazakhstan to prioritize Rosatom’s bid. A primary leverage point is Kazakhstan’s reliance on Russian territory for transporting export-bound oil. Approximately 80 percent of Kazakhstan’s oil exports pass through Russia, and oil revenue constitutes about two-thirds of Kazakhstan’s national budget. Any disruption in this transit route could precipitate a fiscal crisis for Kazakhstan, with severe implications for the stability of its national budget. A second leverage point is Russia’s role in alleviating Kazakhstan’s energy deficit through electricity exports. Russian experts warn that any abrupt cessation of this supply could lead to severe energy shortages in Kazakhstan, potentially triggering economic and political instability. These pressure points are further highlighted by recent incidents, such as the explosion at Kazakhstan’s Tengiz oil field, which occurred shortly after President Tokayev discussed with EU officials increasing Kazakh oil exports to compensate for reduced Russian supplies. These events suggest that- Should Kazakhstan consider alternatives to Russia for its NPP construction, it might face similar pressures or retaliatory actions from Moscow. Kazakhstan’s reliance on Russia for both oil export infrastructure and electricity supply exposes the country to significant vulnerabilities. Nearly 80 percent of Kazakhstan’s oil exports pass through Russian territory, and oil revenues account for approximately two-thirds of the national budget. Any disruption to this transport network could result in severe economic consequences, potentially destabilizing Kazakhstan’s fiscal position. Similarly, Kazakhstan’s electricity deficit is largely covered by imports from Russia. Russian experts caution that if Russia were to cut off this supply, Kazakhstan would face a precarious situation, where both political stability and economic restructuring could become unfeasible. These dependencies highlight Kazakhstan’s vulnerability to Russian influence, as demonstrated by the 2022 explosion at the Tengiz oil field, the country’s largest, which occurred shortly after President Tokayev’s discussions with EU officials about increasing Kazakh oil exports to compensate for reduced Russian supply due to the invasion of Ukraine. This incident underscores Russia’s capacity—and potential willingness—to retaliate against Kazakhstan should the country act in ways that conflict with Russian interests. A third option is to form an international consortium to oversee the construction of the NPP. This approach could provide a balanced compromise, allowing Russia to participate without being the sole contractor, thus reducing the risk of secondary economic sanctions. Such an arrangement might appeal to Moscow, as it would obscure Rosatom’s central role while still involving Russian expertise. Notably, President Tokayev has rhetorically supported the idea of an “international consortium,” suggesting that this could be the most feasible solution. However, several uncertainties surround the international consortium option. A significant challenge is that the construction of the nuclear reactor, the core component of the NPP, cannot be easily divided among multiple parties. This raises the critical issue of who would be responsible for sourcing and manufacturing the reactor, as the origin of this essential component remains unclear. Furthermore, the distribution of responsibilities within the consortium could lead to complications. Some members would likely take leadership roles, while others would play secondary, supportive functions. The precise allocation of these roles, and how they align with the interests of the participating companies, remains uncertain, potentially creating tensions within the consortium and complicating cooperation and decision-making.

CONCLUSIONS: The construction of Kazakhstan’s NPP will provide crucial insight into Russia’s influence in Central Asia, a region where assertions of Russia’s diminishing role may underestimate its true significance. The outcome of this project could offer a clearer picture of Russia’s geopolitical and economic standing in the region. If Kazakhstan ultimately selects Rosatom as the sole bidder—an outcome that seems less probable—or if Russia’s state corporation participates within an international consortium, it will symbolize Russia’s continued strategic presence in Central Asia. Such a scenario would highlight Russia’s ability to retain substantial leverage in the region, despite competing global interests. Whether as the lead contractor or a key consortium member, Rosatom’s involvement would likely reinforce its central role in the region’s energy infrastructure and broader geopolitical affairs.

AUTHOR’S BIO: Dr. Sergey Sukhankin is a Senior Fellow at the Jamestown Foundation and the Saratoga Foundation (both Washington DC) and a Fellow at the North American and Arctic Defence and Security Network (Canada). He teaches international business at MacEwan School of Business (Edmonton, Canada). Currently he is a postdoctoral fellow at the Canadian Maritime Security Network (CMSN).

Tokayev's Strategy: Balancing Regional Cooperation and Global Ambitions

By Emma Krdzalic

In the heart of Central Asia, Kazakhstan has been steadily asserting itself as a regional powerhouse. At the sixth consultative meeting of Central Asian leaders in Astana in August 2024, President Kassym-Jomart Tokayev convened with his counterparts from Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan to discuss regional unity and a shared vision for the future. This pivotal gathering, which produced the ambitious “Central Asia – 2040” development concept, was a testament to the groundwork Tokayev laid in his 2023 address on sustainable development and prosperity the previous year. His speech then outlined Kazakhstan’s goals of evolving into a stable middle power by fostering deeper cooperation among Central Asian states, and the 2024 summit reinforced his vision with concrete actions and agreements. By merging strategic foresight with regional collaboration, Tokayev is positioning Kazakhstan as a mediator and a leader capable of navigating Central Asia through modern geopolitical challenges.

BACKGROUND: Kazakhstan’s journey to middle-power status has been driven by several factors, including its rich natural resources, strategic location, and a sensible foreign policy that balances relationships with global powers including Russia, China, Iran, and the West. The country’s role as a key player in the Central Asian region is further cemented by its participation in global organizations such as the United Nations, the Eurasian Economic Union (EAEU), Shanghai Cooperation Organization (SCO), Organization of Islamic Cooperation (OIC), North Atlantic Cooperation Council (NACC), Collective Security Treaty Organization (CSTO), and the Commonwealth of Independent States (CIS). However, Kazakhstan faces significant challenges in its role as a mediator and middle power due to the decline of the liberal international order, which has traditionally supported such nations. The erosion of norms that regulate state behavior has diminished Kazakhstan’s ability to act as a mediator in global conflicts, particularly in an era of heightened tensions between Russia and the West. Additionally, increased cooperation among revisionist powers like Russia, China, and Iran further complicates Kazakhstan’s strategic position, as these nations challenge the liberal international system that Kazakhstan relies on. The ongoing economic tensions between Russia and the West have disrupted key trade routes, forcing Kazakhstan to seek costlier alternatives and exacerbating the challenges of being landlocked. Despite these obstacles, Kazakhstan is adapting by leveraging its geographic advantages, strengthening regional partnerships, and exploring new trade routes that may offer fresh opportunities for influence and collaboration. Internally, President Tokayev has demonstrated a keen understanding of Kazakhstan’s challenges, particularly in maintaining political stability and responding to public demands for reform. The events of early 2022, when an attempted coup exposed rifts within the elite, highlighted the need for Tokayev to consolidate power and initiate meaningful reforms. While some steps have been taken to address these challenges, such as regaining control over state institutions and exploring new regional partnerships, the government faces a delicate balancing act. It must navigate the competing interests of various elite groups, respond to public demands for change, and maintain its strategic position in a shifting global landscape. The success of Kazakhstan’s “New Kazakhstan” initiative will largely depend on its ability to implement genuine reforms while maintaining stability and leveraging its geographic advantages in an increasingly complex international environment. While Tokayev has succeeded in regaining control over state institutions, the underlying tensions within the political elite remain, posing long-term challenges to the country’s stability.

IMPLICATIONS: To address these challenges, Tokayev has prioritized reforms aimed at improving governance, expanding human capital development, and enhancing the country’s competitiveness on the global stage. A key aspect of these reforms is Tokayev’s focus on education and culture. Kazakhstan has actively expanded its partnerships with top universities and invited Central Asian youth to study in the country, recognizing the importance of education in fostering innovation and economic growth. This strategy not only builds a more skilled workforce but also strengthens Kazakhstan’s regional influence by creating educational ties with neighboring countries. Pouring resources and effort into this cause, if done well, will ultimately give Kazakhstan long-term solutions and results that not only support the current state of the country but also build an overall more educated population that fosters stability and cooperation within the region. Additionally, Tokayev has called for greater cooperation in information and analytics, suggesting the creation of joint media products and even a pan-regional TV channel or internet news portal. This initiative is part of a broader effort to enhance Kazakhstan's soft power in the region and promote cultural and humanitarian cooperation. By investing in these areas, Tokayev aims to build a more cohesive regional identity while showcasing Kazakhstan as a model for development and modernization. On August 9th, President Tokayev underlined Kazakhstan’s strategic course for strengthening regional partnerships and increasing the role of Central Asia on the global scale at the sixth consultative meeting of Central Asian heads of state. This showed that Kazakhstan, as a middle power, has a unique role in shaping the future of Central Asia. Its geographic location as a bridge between the Caspian Sea and China, coupled with its economic interests across the region, positions Kazakhstan as a key player in the East-West corridor. However, Kazakhstan’s success as a middle power will depend not only on its ability to manage relationships with great powers but also on its cooperation with other regional states. Tokayev proved himself to be making consistent and conscious efforts to promote these ideals in this meeting through his speech, which supported models and roadmaps for continuous cooperation in a variety of sectors for Central Asia. Additionally, Tokayev’s advancements in cooperation with states like Uzbekistan and Azerbaijan support his claim to commit to regional cooperation that would stabilize the Central Asian region. The partnerships with Uzbekistan and Azerbaijan, both of which are emerging as aspiring middle powers, are crucial for the stability and development of Greater Central Asia. These partnerships facilitate trade, security cooperation, and regional integration, while also counterbalancing the influence of larger powers like Russia and China. At the same time, Kazakhstan’s role in stabilizing smaller states in the region, such as Kyrgyzstan and Tajikistan, is essential for maintaining peace and security in Central Asia. Tokayev’s efforts to reinforce Kazakhstan’s influence are evident in his focus on strengthening regional alliances, particularly with Uzbekistan. Recent visits to Astana by Uzbek President Shavkat Mirziyoyev have marked a new era of cooperation between the two countries, leading to strategic partnerships in the trade, transport, energy, and agriculture sectors. The leaders signed key documents, including the 2040 Concept for Regional Development and a roadmap for industrial cooperation, deepening economic and cultural ties. With nearly 70 joint projects valued at over US$ 3 billion and employing 14,000 people, the partnership aims to enhance connectivity and create new trade corridors. Additionally, agreements on water resource management and cultural cooperation for 2024-2025 further highlight the countries’ commitment to regional sustainability and shared values.

CONCLUSIONS: Kazakhstan’s rise as a middle power is a complex balancing act that requires both internal reforms and strategic external partnerships. In his August speech, President Tokayev outlined a clear vision for Kazakhstan’s future, emphasizing sustainable development as a pathway to long-term prosperity. The country’s middle-power status depends on its ability to navigate geopolitical challenges while fostering strong regional alliances, particularly with Uzbekistan, and ensuring internal stability through meaningful reforms. President Tokayev’s response to Kazakhstan’s rise as a middle power reflects a forward-looking strategy emphasizing regional cooperation, domestic reforms, and global engagement. By expanding educational and cultural ties, enhancing cooperation in information and analytics, and strengthening alliances with neighboring countries, Tokayev is positioning Kazakhstan as a key player in the future of Central Asia. However, the challenges posed by geopolitical tensions, economic disruptions, and internal political dynamics remain significant. Tokayev’s ability to navigate these challenges will determine whether Kazakhstan can sustain its middle-power status and continue to play a stabilizing role in the region. Tokayev’s efforts as Kazakhstan moves forward to maintain its middle-power role have not gone unnoticed as Kazakhstan confirms and fortifies its partnerships with countries like Uzbekistan and Azerbaijan, as well as its engagement with Central Asia and the broader international community. The path it remains on will be key to its success in shaping the future of Central Asia and beyond.

AUTHOR’S BIO: Emma Krdzalic is a current intern at the American Foreign Policy Council (AFPC), where she researches National Security dynamics, Russia, Russia-Ukraine, Central Asia, and the Caucasus. She is a student at the University of Georgia, pursuing her studies in International Relations, Political Science, and Russian while interning in Washington, D.C. through the Washington Semester Program.

Silk Road Paper S. Frederick Starr,

Silk Road Paper S. Frederick Starr,  Book Svante E. Cornell, ed., "

Book Svante E. Cornell, ed., "